the ascent of the USDT: Understanding of the Role of Tether in Cryptocurrency Exchanges

In recent years, the world of cryptocurrencies has undergone a significant increase in adoption, with millions of users all over the world that invested in digital currencies such as bitcoin, ethereum and others. However, a key component that has played a vital role in the development and growth of these digital resources is tether (USDT), a stablecoin widely used.

What is tether?

Tether, also known as usdt, is a decentralized stablecoin anchored to the value of the United States Dollar. It was launched in 2014 by Tether Limited, an American society founded by Anthony “Tony” Mullen and Christopher “Chris” Lee. The main purpose of the coin is to maintain a stable price compared to the us dollar, ensuring that investors can easily buy and sell cryptocurrency without worrying about the value of their activity that float wildly.

how does the tether work?

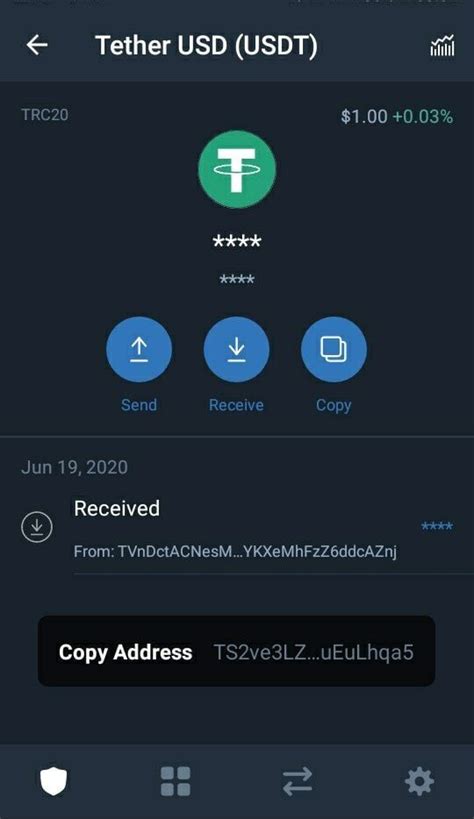

Tether’s innovative technology allows unwilling integration with traditional financial systems, making it an interesting option for both institutions and people. The process is simple: when it deposits usdt in an exchange based on tether, such as coinbase or Binance, the exchange converts the amount anchored for the Fiat Currency (US Dollars) in Real Time. This Guarantees that your resource remains stable with respect to the value of the dollar.

Role in Cryptocurrency Exchanges

In today’s cryptocurrency panorama, tether plays a fundamental role in facilitating commercial activities in various exchanges. Here are some key ways in which the tether contributes to the ecosystem:

- Marking Liquide : By providing a stable and widely accepted peg, the tether allows traders to buy or sell cryptocurrencies with confidence. This increase in market liquidity has contributed to reducing prices volatility and has created more opportunities for investors.

- Increase in Adoption

: As institutional investors and retail traders feel comfortable with the purchase and sale of tether, increased the demand for activities based on the USDT, which in turn feeds growth in the cryptocurrency ecosystem.

- Best Security : Tether’s decentralized Nature means that users are protected from the risk of counterparty, making it a more interesting option than centralized stablecoins such as the USDC (ECO USD-C).

4 Tether’s decentralized architecture makes him an attractive choice for regulators who try to minimize risks.

Notable Exchanges with the Link

Several exchanges of cryptocurrency have integrated the link into their platforms, offering users with an unprecedented experience:

- Coinbase : Coinbase, one of the largest and most well well -known exchanges of cryptocurrency, offers usdt as a native resource on its platform.

- Binance : Binance, Another prominent exchange, supports USDT trading through a variety of trading couples.

- Kraken : Kraken, a global cryptocurrency trading platform, also accepts tether as a stableCoin.

Future Challenges and Perspectives

While tether’s role in the cryptocurrency ecosystem is undeniably significant, it is not without Challenges:

1

2

Despite These Challenges, the Future of the USDT SEEMs Promising:

- Institutional Demand Growth : As Institutional Investors Increase Their Involvement In Cryptocurrency Markets, We Can Expect That Tether’s Role Will Expand.

2.

Leave a Reply