“Cryptonuts and Chaos: How to Navigate the Fractured Crypto Market with Careful Portfolio Diversification”

In the world of cryptocurrencies, innovation and speculation have created a situation where few investors can truly succeed. However, by understanding the intricacies of token minting, diversifying their portfolio, and harnessing the power of the mean convergent deviation (MACD), savvy investors can navigate the choppy waters and ride the waves of cryptocurrency market volatility.

Token Minting: A Double-Edged Sword

Token minting has become a popular trend in the cryptocurrency space, with new projects and tokens being launched daily. While this has created a wide range of investment opportunities, it also comes with significant risks. Without due diligence, investors can end up holding worthless or even malicious tokens that empty their wallets or cause them financial losses.

To mitigate these risks, diversify your portfolio by investing in multiple assets from different sectors, including blockchain, cybersecurity, and e-commerce. This approach allows you to spread your risk and increase your potential rewards over time. When choosing a project to mint, conduct thorough research on the project team, technology, market demand, and competitive landscape.

Portfolio Diversification: The Key to Avoiding Market Volatility

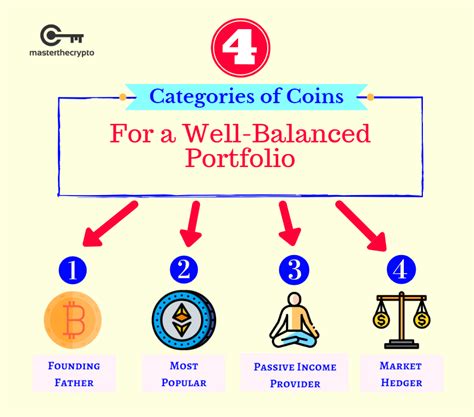

One of the most important elements of a successful cryptocurrency strategy is portfolio diversification. By allocating a significant portion of your assets to different cryptocurrencies, you can reduce your exposure to any particular asset class or market trend. This approach also allows you to ride the waves of market sentiment and capitalize on opportunities that arise in other sectors.

Consider investing in a mix of established coins like Bitcoin (BTC) and Ethereum (ETH), as well as newer projects with innovative technologies and use cases. Keep an eye on market trends, economic indicators, and regulatory changes to make informed investment decisions and adjust your portfolio accordingly.

MACD: A Powerful Market Analysis Tool

Mean Congruent Deviation (MACD) is a technical analysis tool that helps traders and investors identify trends, patterns, and potential breakouts in the cryptocurrency market. Developed by Richard Dennis, MACD uses two leading indicators to generate a single line chart that plots the difference between two moving averages.

The MACD line moves toward zero when there is no change in trend, while it diverges when there is a change. Using this tool, you can gain valuable insights into market sentiment and identify potential entry points for new investments. When analyzing MACD, look for signal lines that cross above or below the zero line, indicating a strong move.

Conclusion

Cryptocurrency investing requires a deep understanding of the intricate mechanics of token minting, portfolio diversification, and the power of MACD analysis. By following these guidelines, investors can navigate the chaotic cryptocurrency market with greater confidence and potentially reap significant rewards. Remember to always do your research, stay up to date on market trends and regulatory changes, and never invest more than you can afford to lose.

Leave a Reply